Keep pace with the Institutional Traders

Direct market access qualification for Tier 1 liquidity

Where your transactions are no longer restricted

-

Reliable Data Transmission Success Rate

98.75%

-

Order Execution Time as low as

20ms

-

Dedicated Fiber Optic Network At Least

100Mbps

Reliable Data Transmission Success Rate

98.75%Order Execution Time as low as

20msDedicated Fiber Optic Network At Least

100Mbps

Technology empowers trading

FMT dedicated servers are set up in Equinix LD4, HK3, TY3, NY4 to build worldwide coverage for the financial ecosystem.

Discover Prices & Transfer Orders

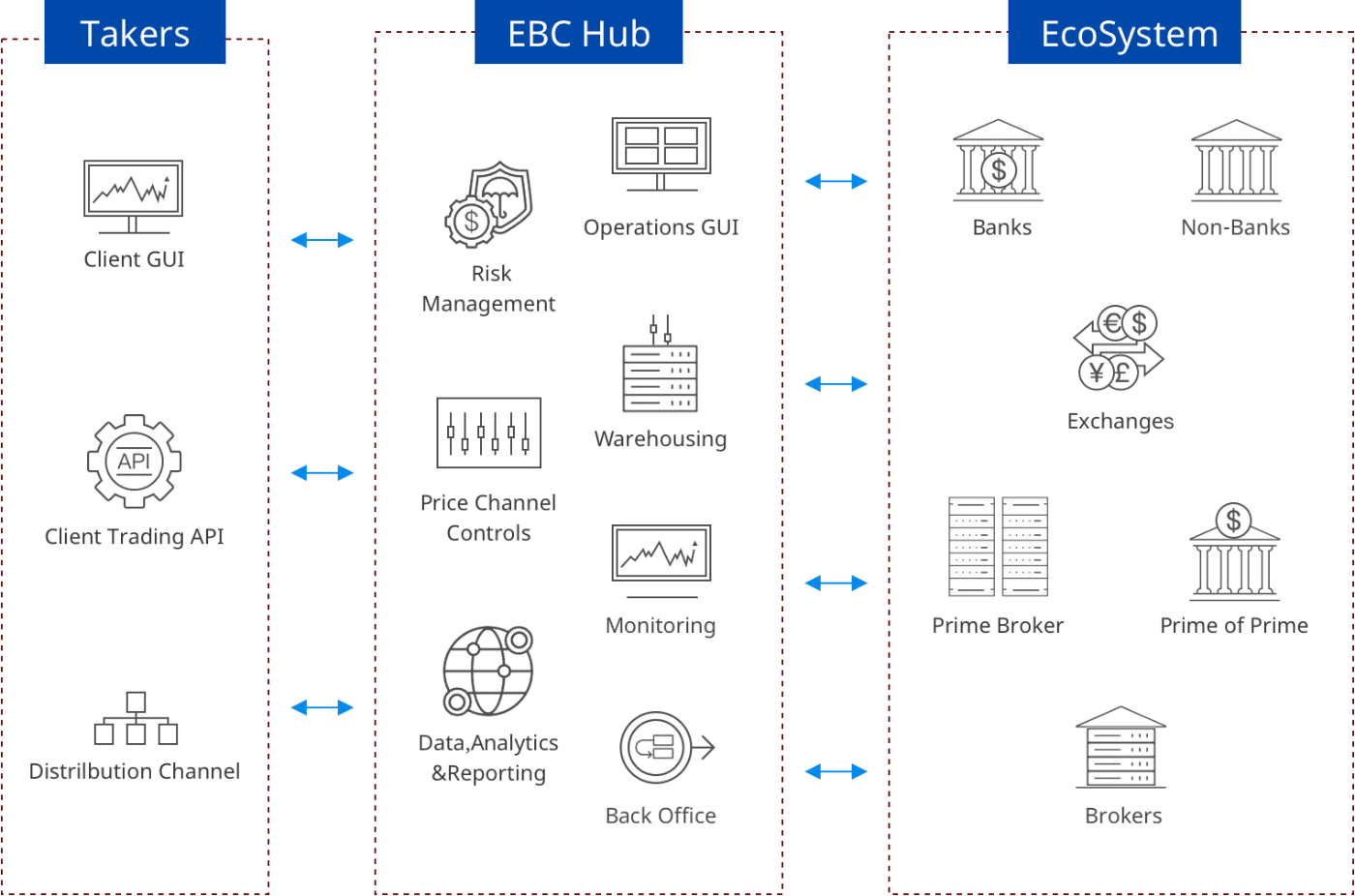

FMT uses FIX (Financial Information Exchange Protocol) to aggregate interbank currency quotes to provide customers with direct access to the markets with optimum liquidity. The quotes aggregated through dedicated physical HUB hardware bring lower spreads and sustainable trading opportunities.

Professional and leading financial technology makes trading with infinite possibilities

POSSIBILITY

We ensure the best liquidity in the trading market, so that you may achieve more flexibility, while obtaining more Multi–Asset Liquidity .

We ensure the best liquidity in the trading market, so that you may achieve more flexibility, while obtaining more Multi–Asset Liquidity .

Minimizing risks and maximizing trading opportunities

FMT's ultra-low delay aggregation, intelligent order routing and quotation optimization engine provide you with higher reliability and optimum order execution.

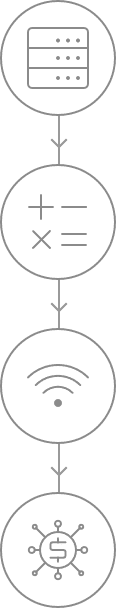

Trading server

Aggregated quotation

Order transmission

Liquidity pool

Institutional Liquidity Depth

Derivatives

Indices

Commodities

Market

Bid

Bid Volume

Spread

Ask

Ask Volume

layer

Bid

Bid Volume

Spread

Ask

Ask Volume

1

1.09847

4000000

0

1.09847

100000

2

1.09847

30000000

1

1.09848

4000000

3

1.09846

100000

2

1.09848

4000000

4

1.09845

8338000

4

1.09849

15000000

5

1.09843

14000000

7

1.0985

30000000

layer

Bid

Bid Volume

Spread

Ask

Ask Volume

1

0.67269

4000000

3

0.67272

4000000

2

0.67269

100000

3

0.67272

100000

3

0.67268

15000000

5

0.67273

15000000

4

0.67268

3600000

5

0.67273

1150000

5

0.67267

30000000

7

0.67274

30000000

layer

Bid

Bid Volume

Spread

Ask

Ask Volume

1

1.30778

4000000

2

1.3078

100000

2

1.30778

100000

4

1.30782

100000

3

1.30777

10000000

6

1.30783

4000000

4

1.30777

1850000

6

1.30783

250000

5

1.30776

20000000

8

1.30784

7500000

layer

Bid

Bid Volume

Spread

Ask

Ask Volume

1

0.61225

1500000

3

0.61228

1500000

2

0.61224

10000000

5

0.61229

10000000

3

0.61223

20000000

7

0.6123

20000000

4

0.61222

30000000

9

0.61231

30000000

layer

Bid

Bid Volume

Spread

Ask

Ask Volume

1

1.36409

1000000

2

1.36411

100000

2

1.3641

100000

2

1.36412

1000000

3

1.36409

20650000

3

1.36412

400000

4

1.36408

7500000

5

1.36413

1750000

5

1.36407

15000000

7

1.36414

7500000

layer

Bid

Bid Volume

Spread

Ask

Ask Volume

1

147.726

4000000

2

147.728

4000000

2

147.726

100000

2

147.728

100000

3

147.727

5000000

2

147.729

5000000

4

147.727

150000

2

147.729

500000

5

147.726

7500000

4

147.73

7500000

layer

Bid

Bid Volume

Spread

Ask

Ask Volume

1

0.85362

100000

3

0.85365

100000

2

0.85361

5300000

5

0.85366

2500000

3

0.85359

2500000

7

0.85366

1500000

4

0.85359

3000000

8

0.85367

5000000

5

0.85358

5000000

10

0.85368

10000000

layer

Bid

Bid Volume

Spread

Ask

Ask Volume

1

1.94399

1500000

17

1.94416

1500000

2

1.94398

3000000

20

1.94418

3000000

3

1.94397

4500000

22

1.94419

4500000

4

1.94396

6000000

24

1.9442

6000000

5

1.94395

7500000

26

1.94421

7500000

layer

Bid

Bid Volume

Spread

Ask

Ask Volume

1

193.196

2500000

9

193.205

100000

2

193.196

100000

10

193.206

2500000

3

193.195

3000000

12

193.207

3000000

4

193.195

2900000

14

193.209

4500000

5

193.193

4500000

16

193.209

778000

layer

Bid

Bid Volume

Spread

Ask

Ask Volume

1

8228.4

100

12

8229.6

100

2

8228.1

180

18

8229.9

180

3

8227.9

260

22

8230.1

260

4

8227.6

410

26

8230.2

410

5

8227.4

610

31

8230.5

610

layer

Bid

Bid Volume

Spread

Ask

Ask Volume

1

8168.1

100

22

8170.3

100

2

8166.6

225

47

8171.3

225

3

8164.4

475

88

8173.2

475

layer

Bid

Bid Volume

Spread

Ask

Ask Volume

1

38857.5

8000

130

38870.5

8000

2

38854.8

13000

184

38873.2

13000

3

38851

20500

0

38877

20500

4

38848.2

30500

316

38879.8

30500

5

38841.2

50500

456

38886.8

50500

layer

Bid

Bid Volume

Spread

Ask

Ask Volume

1

18966.7

300

13

18968

300

2

18966.4

400

18

18968.2

400

3

18965.8

500

30

18968.8

500

4

18965.2

600

40

18969.2

600

5

18964.5

775

55

18970

775

layer

Bid

Bid Volume

Spread

Ask

Ask Volume

2

7506.2

150

32

7509.4

150

3

7505.9

350

39

7509.8

350

4

7505.2

650

50

7510.2

650

layer

Bid

Bid Volume

Spread

Ask

Ask Volume

1

21181.8

150

145

21196.3

150

2

21180.3

400

161

21196.4

400

3

21179.4

700

180

21197.4

700

layer

Bid

Bid Volume

Spread

Ask

Ask Volume

1

19813.7

80

7

19814.4

80

2

19813.1

200

19

19815

200

3

19812.4

340

33

19815.7

340

4

19811.7

540

46

19816.3

540

5

19810.9

840

62

19817.1

840

layer

Bid

Bid Volume

Spread

Ask

Ask Volume

1

5702.82

500

31

5703.13

500

2

5702.62

1500

71

5703.33

1500

3

5702.36

2500

123

5703.59

2500

4

5702.1

4000

175

5703.85

4000

5

5701.82

5500

238

5704.2

5500

layer

Bid

Bid Volume

Spread

Ask

Ask Volume

1

41975.4

30

13

41976.7

30

2

41973.1

60

48

41977.9

60

3

41971.2

110

86

41979.8

110

4

41969.1

210

128

41981.9

210

5

41965.4

510

202

41985.6

510

layer

Bid

Bid Volume

Spread

Ask

Ask Volume

1

2638.32

2000

3

2638.35

2500

2

2638.31

2000

4

2638.35

2000

3

2638.3

2000

8

2638.38

2500

4

2638.28

2000

11

2638.39

3000

5

2638.27

2000

12

2638.39

2000

layer

Bid

Bid Volume

Spread

Ask

Ask Volume

1

31.157

7200

15

31.172

7200

2

31.156

10000

17

31.173

15000

3

31.155

20000

19

31.174

30000

4

31.154

30000

21

31.175

45000

5

31.153

45000

23

31.176

60000

layer

Bid

Bid Volume

Spread

Ask

Ask Volume

1

79.344

500

30

79.374

500

2

79.336

2500

47

79.383

2500

3

79.33

17000

6

79.39

17000

4

79.325

80000

70

79.395

80000

layer

Bid

Bid Volume

Spread

Ask

Ask Volume

1

75.343

500

33

75.376

500

2

75.336

2500

49

75.385

2500

3

75.333

17000

56

75.389

17000

4

75.325

80000

71

75.396

80000

layer

Bid

Bid Volume

Spread

Ask

Ask Volume

1

3.0119

10000

62

3.0181

10000

2

3.0109

40000

82

3.0191

40000

3

3.0099

50000

102

3.0201

50000

4

3.0089

100000

122

3.0211

100000

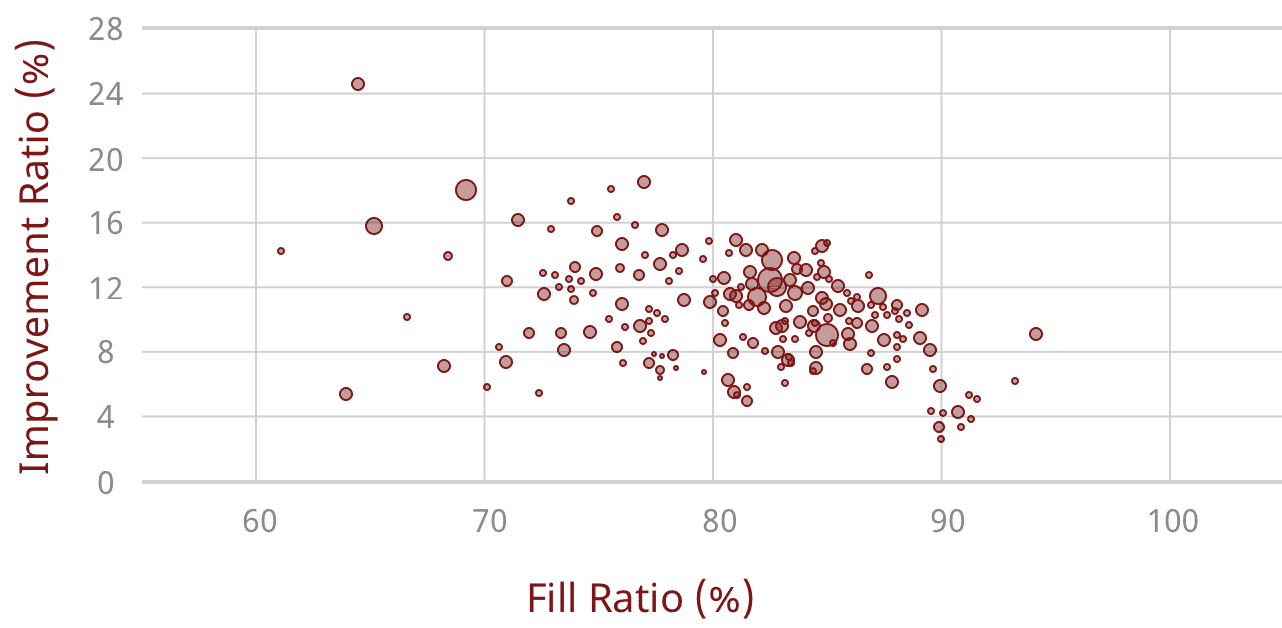

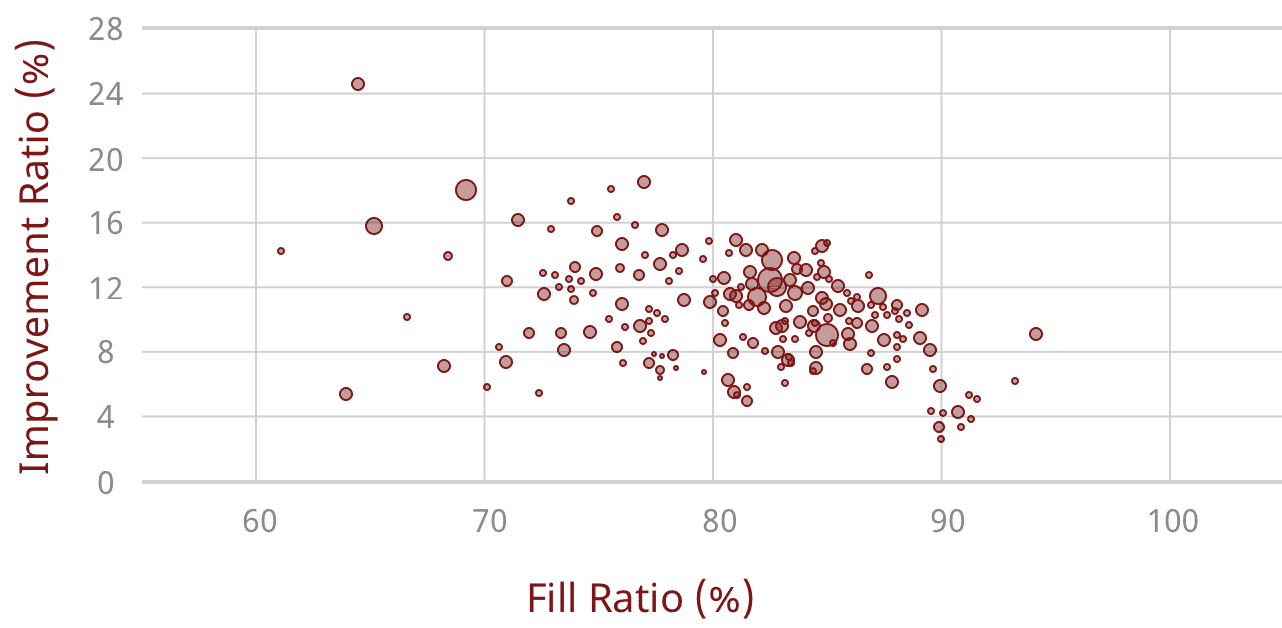

Trading Black-Box

Enabling more than 85% of orders filled at a better price

FMT trading black box, based on tens of millions of historical trading data, traders'trading habits,user attributes and other portraits,the current market situation and trading network environment,uses big data statistical analysis,probability model,neural network model,system control theory model and artificial intelligence algorithm to conduct comprehensive research and judgment,and finally matches the LP that is more suitable for each trader's attributes, Achieve the best transaction price

The following distribution diagram demonstrates the comparing results between FMT trading black box and traditional trading system (containing at least 100 orders):

each data point represents a day's transaction

each data point represents a day's transaction

the horizontal axis indicates the transaction rate of the order

the horizontal axis indicates the transaction rate of the order

the size of the point represents the relative size of the order quantity

the size of the point represents the relative size of the order quantity

the vertical axis indicates the optimization rate of the transaction price

the vertical axis indicates the optimization rate of the transaction price

This experience confirmed that FMT trading black-box is far superior to the traditional trading system in terms of price optimization rate, order transaction rate and algorithm stability.